Types of Accounts: Modern and Traditional Classifications

There is no physical existence of nominal accounts, but money is involved behind every such account even though they have no physical form. Tangible real accounts are related to things that can be touched and felt physically. A few examples of tangible real accounts are building, furniture, equipment, cash in hand, land, machinery, stock, investments, etc. After that, the balance is transferred in a T-shaped table that contains all debit transactions on the lef, and the right-hand side includes all credit transactions. When you draw up the chart for your accounts, set it up so you won’t have to change it for several years.

Nominal accounts

Businesses using accrual-based accounting need one since the income statement records sales and purchases, not cash payments. Tracking how much cash moves in and out of the company shows whether the company has enough money on hand to make loan payments or cover payroll. If the cash flowing in is significantly less than the income, it’s possible the company’s not doing a good job collecting on accounts receivable.

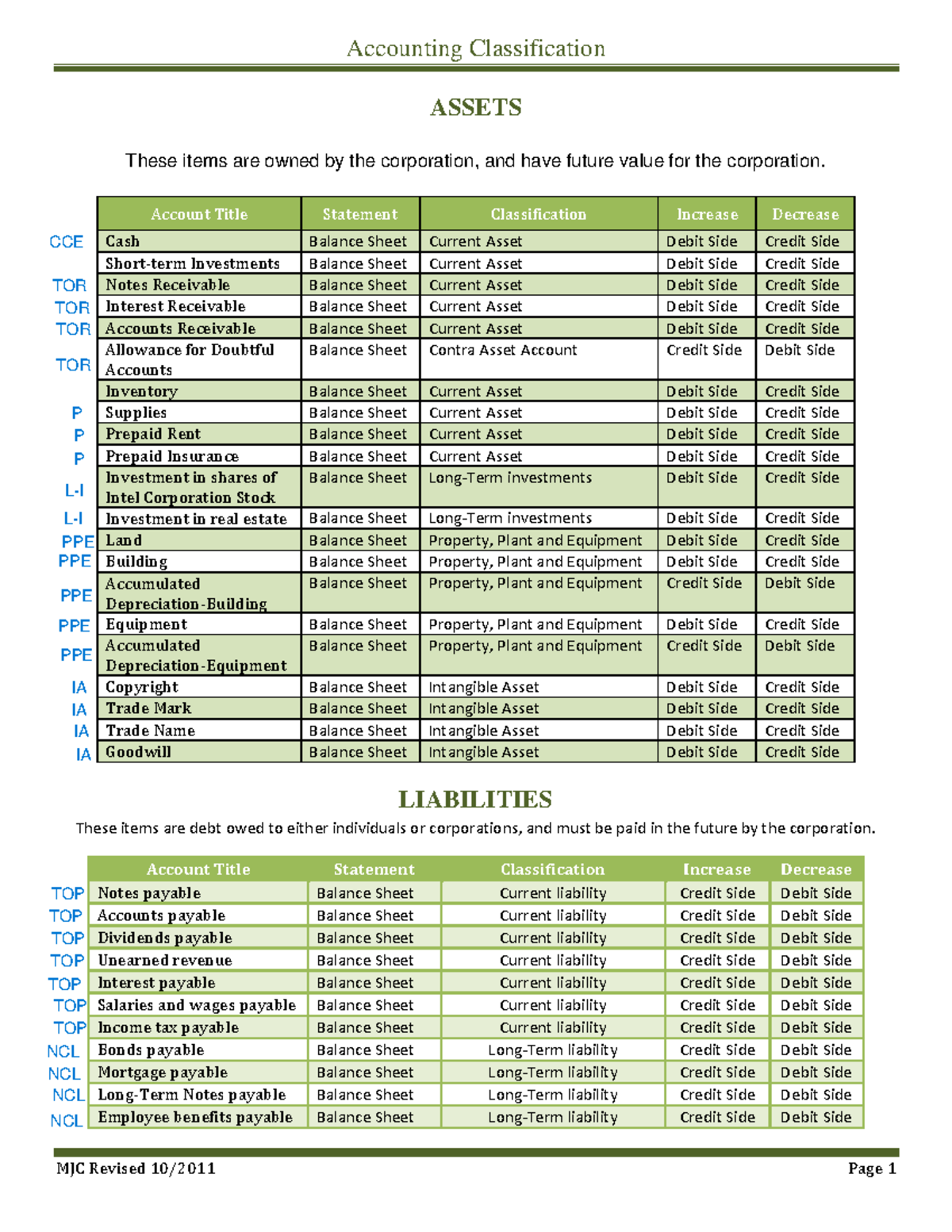

Asset accounts:

Current assets are the ones that will be used up in the coming year. Accountants also classify tangible and intangible assets separately. Tangible assets include physical items such as trucks, 3D printers and inventory. Intangible assets are nonphysical property such as patents, copyrights and customer goodwill. Classifying your accounts aggregates your finances into different categories in your ledgers and financial statements.

To Ensure One Vote Per Person, Please Include the Following Info

Familiarize yourself with and learn how debits and credits affect these accounts. Then, you can accurately categorize all the sub-accounts that fall under them. Read on to learn about the different types of accounts with examples, dive into sub-accounts, and more. A company’s financial statements are constructed using the five elements.

In balance sheet, the balance in the accumulated depreciation account is deducted from the original cost of the asset to report it at its book value or carrying value. Another example of valuation account is allowance for doubtful accounts. In balance sheet, the balance in allowance for doubtful accounts is deducted from the total receivables to report them at their net realizable value or carrying value. Capital is the owner’s claim against the assets of the business and is equal to total assets less all liabilities to external parties.

Valuation account (also known as contra account) is an account which is used to report the carrying value of an asset or liability in the balance sheet. A popular example of valuation account is the accumulated depreciation account. Companies maintaining fixed assets in the books of accounts at their original cost also maintain an accumulated depreciation account for each fixed asset.

First, the executives access the information of financial accounting followed by the cost accounting. There are several data analysis processes they carry out to extract the necessary data. The goal of accounting is to collect data and to prepare reports on financial statements, about the performance of the firm, whether it is running smoothly, its financial situation, and the cash flows of a business. The foundation of accounting lies in the accounting equation, which states that a company’s Assets are equal to the sum of its Liabilities and Equity. This equation governs the double-entry accounting system, where each transaction affects at least two accounts, maintaining the balance between assets, liabilities, and equity. A company’s financial data becomes unreliable when debit and credit rules are incorrectly applied.

Maintaining accounts time-to-time helps business personnel in quick decision-making accounts help them to analyze the transactions regarding their expenses, benefits, and losses. Business people can make quick decisions and implement changes regarding various aspects required. Hence maintaining accounts definitely helps to make quick decisions in business. Maintaining accounts for every form is really very important to analyze the growth of the business. The accounts show the detailed information of entire transactions of a firm regarding whether it is going in profits or losses. It also helps the business to make some quick decisions regarding the firm so that the changes can be made within the time, for betterment.

- The three financial statements consolidate a company’s financial records in different ways and classify accounts in different ways.

- The use of traditional approach is very limited and it will be discussed later.

- Note that every business will have a different chart of accounts based on its business activities.

- Management Accounting or Managerial Accounting helps managers to make and implement business policies for better results.

- An example of an Expense account would be a typical business expense, such as your rent payment on a physical business location.

In sole proprietorship and partnership, an account titled as drawings account is used to account for all withdrawals. In corporate form of business withdrawals are more systematic and usually termed as distributions to stockholders. The account used for recording such distributions is known as dividend account. (d) recognition and measurement should i use an accountant or turbotax principles laid down in paragraphs 129 to 131 of the Standard in respect of accounting for other long-term employee benefits. Use the list below to help you determine which types of accounts you need in business. Here are some accounts and sub-accounts you can use within asset, expense, liability, equity, and income accounts.