Before changing the property to rental use last year, Nia paid $20,000 for permanent improvements to the house and claimed a $2,000 casualty loss deduction for damage to the house. Land is not depreciable, so Nia includes only the cost of the house when figuring the basis for depreciation. Divide the balance by the number of years in the useful life.

Causes of Depreciation

In the fiscal year 2021, the company recorded $2.48 billion in depreciated expenses and had $24.42 billion in accumulated depreciation. Section 1231 applies to all depreciable business assets owned for more than one year, while section 1250 (and also 1245) provides guidance on how different asset categories are taxed when sold at a gain or loss. All property https://www.bookstime.com/articles/form-w8 used in a trade or business is considered section 1231 property and, for taxation purposes, either section 1245 or 1250 applies, depending on the property’s characteristics. If you are starting your rental activity and don’t have 3 years showing a profit, you can elect to have the presumption made after you have the 5 years of experience required by the test.

- This use of company automobiles by employees is not a qualified business use.

- Since land doesn’t wear out, become obsolete, or get used up, it doesn’t have a useful life.

- If you selected a 15-year period for this property, use 6.667% as the percentage.

- In 2023, Jane Ash placed in service machinery costing $2,940,000.

- Your property tax was based on assessed values of $10,000 for the land and $25,000 for the house.

- The partnership’s taxable income from the active conduct of all its trades or businesses for the year was $1,110,000, so it can deduct the full $1,110,000.

What Is Rental Property Depreciation And How Does It Work?

Divide a short tax year into 4 quarters and determine the midpoint of each quarter. Under the mid-month convention, you always treat your property as placed in service or disposed of on the midpoint of the month it is placed in service or disposed of. A quarter of a full 12-month tax year is a period of 3 months. The first quarter in a year begins on the first day of the tax year.

Deductions Vs. Depreciation

Instead of selling the house you had been living in, you decided to change it to rental property. You selected a tenant and started renting the house on February 1. Because you plan to return it to your tenant at the end of the lease, you don’t include it in your income. Your depreciation deduction for the year can’t be more than the part of your adjusted basis (defined in chapter 2) in the stock of the corporation that is allocable to your rental property. If you or your spouse actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive income. This special allowance is an exception to the general rule disallowing losses in excess of income from passive activities.

- Don’t count such a day as a day of personal use even if family members use the property for recreational purposes on the same day.

- While less expensive items such as office equipment and furniture have a recovery period of 7 years, residential buildings are depreciable over 27.5 years and commercial properties have a 39-year recovery period.

- Employees claiming the standard mileage rate may be able to use Form 2106-EZ.

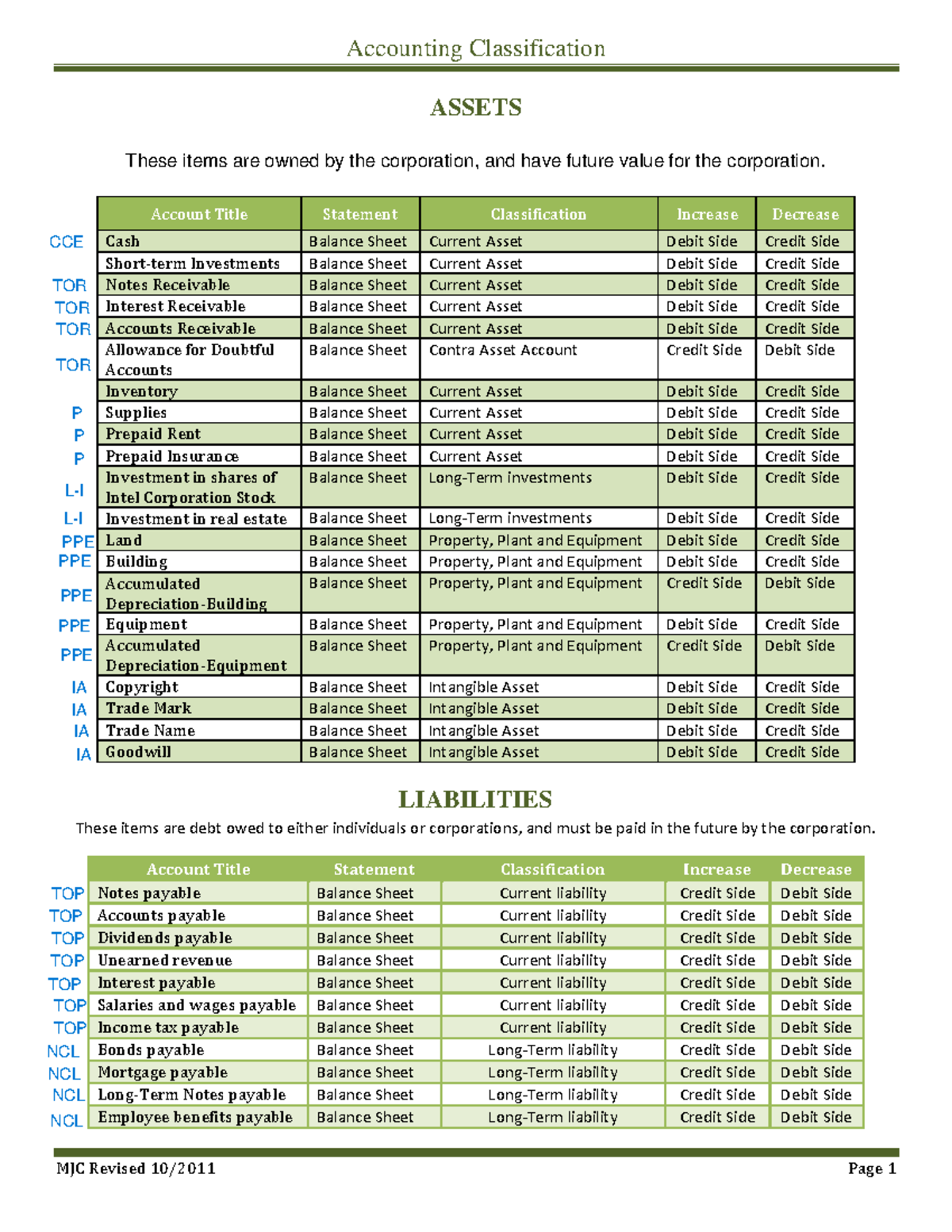

- The Modified Accelerated Cost Recovery System (MACRS) is used to recover the basis of most business and investment property placed in service after 1986.

- He is entitled to reimbursement for the remaining half from the co-owner.

- You enter your income, expenses, and depreciation for the house in the column for Property A and enter your loss on line 22.

For the year of the adjustment and the remaining recovery period, you must figure the depreciation yourself using the property’s adjusted basis at the end of the year. The basis for depreciation of MACRS property is the property’s what is depreciable property cost or other basis multiplied by the percentage of business/investment use. For a discussion of business/investment use, see Partial business or investment use under Property Used in Your Business or Income-Producing Activity in chapter 1. Reduce that amount by any credits and deductions allocable to the property. The following are examples of some credits and deductions that reduce basis. In 2023, Beech Partnership placed in service section 179 property with a total cost of $2,940,000.

What Is Passive Real Estate Investing And How Does It Work?

Under the mid-month convention, treat real property disposed of any time during a month as disposed of in the middle of that month. The law provides https://x.com/BooksTimeInc a special rule to avoid the calculation of gain on the disposition of assets from mass asset accounts. A mass asset account includes items usually minor in value in relation to the group, numerous in quantity, impractical to separately identify, and not usually accounted for on a separate basis, but on a total dollar value. Examples of mass assets include minor items of office, plant, and store furniture and fixtures.