For a custodial pockets establishment, a Web3 founder should be very aware of the comprehensive–and typically extensive–list of necessities in regards to the jurisdiction the place they want to incorporate. To adjust to rules, most custodial platforms would require https://www.xcritical.com/ you to complete a know-your-customer (KYC) or anti-money laundering (AML) verification. Like each different financial platform, they are required to collect private information to confirm your identity, monitor your transactions, and report any suspicious activity.

Non-custodial wallets are gaining continued traction also via the advent of account abstraction (AA) and its advantages within the Ethereum area. Leveraging AA and features like social login/recovery and dApp integration might make non-custodial wallets the most secure and most feature-rich choice for the future. However, experienced crypto enthusiasts usually favor non-custodial wallets for his or her control, flexibility and security, especially when holding long-term property. Custodial and non-custodial wallets are different purposes of private key administration. However, you must make sure that your wallet supports the cryptocurrency you plan to store.

What Is A Custodial Wallet?

Non-custodial wallets are for these users who want to exert more control over who has entry to their funds. There are professionals and cons for each kinds of wallets, so weigh your consolation level with the features that matter most to you earlier than deciding. You’ll additionally want custodial vs non-custodial to think about the perks every wallet presents, like crypto debit or bank cards, staking alternatives, cashback rewards and the number of coins supported. For custodial crypto wallets, the wallet provider is tasked with securely storing the user’s private key.

Although customers are taking the danger of losing their funds into their very own hands, non-custodial crypto wallets offer higher protection in opposition to a knowledge breach than custodial wallets. Some non-custodial wallets require web connectivity to function, however, so offline hardware wallets are normally the safest option on this regard. A non-custodial crypto pockets is one during which only the holder can access and control the non-public keys. Non-custodial wallets are the finest choice for customers who want complete management over their funds.

Custodial Vs Non-custodial Crypto Wallets: What’s The Difference?

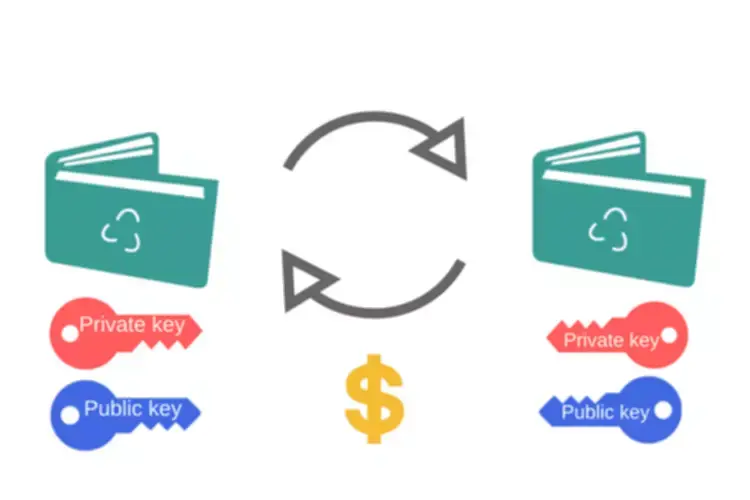

This reduces the danger of information being stolen, except the person shares the small print with somebody, or their device gets stolen. A Custodial Wallet is defined as a pockets in which the non-public keys are held by a 3rd celebration. Meaning, the third get together has full management over your funds whilst you only have to offer permission to send or obtain payments.

They often offer additional providers such as buying and selling and lending, which could be handy for customers on the lookout for easy all-in-one options. But before diving into custodial vs. non-custodial crypto wallets, we ought to always perceive crypto keys and their capabilities in wallets. This, however, implies that you’re entrusting your private keys to a 3rd celebration.

Pay With Crypto From Brave Wallet With Bitpay On-line & In-store

When researching custodial pockets suppliers, guarantee they’re regulated, and find out how your private keys are stored and whether or not there is insurance coverage. Custodial wallets are like centralized banks, holding your belongings and keys while managing transactions for you. On the other hand, non-custodial wallets put you within the driver’s seat and hand the keys to you, granting you full management and duty. Custodial crypto wallets compliant with present regulatory regimes are usually safer than non-compliant wallets. Users can also go for custodial wallets that offer insurance coverage coverage for theft or misuse of funds.

They provide an option to put money into cryptocurrency that doesn’t require managing keys or transacting on the blockchain. They do, nonetheless, charge larger fees and solely provide exposure to a fraction of the cryptocurrencies and trading pairs provided on exchanges. A custodial pockets service (like Coinbase or Kraken) holds on to the non-public key, so it is answerable for safeguarding a user’s funds. A non-custodial wallet (also often recognized as a self-custody wallet) however, provides users full control over their non-public key, and with it sole responsibility for safeguarding their holdings.

Custodial Vs Non-custodial Wallets: Key Variations

Additionally, self-custody choices don’t require customers handy over any information through a KYC or AML course of. Exchanges are recognized to be the holders of personal keys, and their providers are interacted with on-line, which makes them a steady target for hackers. You could even lose your funds to authorities seizure in the event an change that holds your non-public key goes bankrupt. Yes, non-custodial wallets are often secure for customers, however it’s the user’s accountability to keep their non-public keys secure and have a correct backup. A personal key’s a cryptographically generated string of characters that acts as a password to handle user funds and create a backup wallet on a new gadget.

- In fact, they are simply the tool via which a person can entry their funds on the blockchain and initiate crypto transactions.

- Non-custodial wallets that are continuously upgrading to fulfill the demands of their users could eventually assist more tokens.

- Custodial pockets users can depend on the custodian to retrieve their password in the case of loss.

- In reality, most companies providing custodial pockets services are well-known and established crypto exchanges like Coinbase, Kraken and Crypto.com.

- Additionally, you have to select between a hot and cold pockets, depending on whether or not you want it to be connected to the Internet or not.

The major distinction between custodial and non-custodial wallets lies in managing personal keys. Understanding these variations is paramount when selecting the best pockets. Users with non-custodial wallets basically become their very own banks with round-the-clock access to their funds. These non-custodial wallets are good for skilled merchants able to shoulder the nice accountability of storing their keys safely. In the case of Custodial cryptocurrency exchanges, a huge amount of users’ funds is stored in cold and warm wallets. While these wallets may not be a simple target for hackers because of the involvement of various conformations, they’re still susceptible to security breaches.

Non-custodial Vs Custodial Wallets: What’s The Difference?

Custodial wallets additionally give customers peace of thoughts that a lost or forgotten password doesn’t imply they lose access to their funds. Most of the time suppliers or exchanges can simply reset your password with a couple of security questions. If a non-custodial pockets holder loses their non-public key, their funds could be unrecoverable. Non-custodial wallets provide you with full control over your keys and funds and not utilizing a third-party guardian. Furthermore, non-custodial transactions are sometimes quicker as a result of there isn’t a want for withdrawal approval. If you do not use a custodian, you keep away from paying further custodial charges, which could be costly depending in your service provider.

How you safeguard and entry that vault depends on the sort of pockets you select. Users want to complete Know Your Customer (KYC) and Anti Money Laundering (AML) types for security and regulatory compliance. With a custodial wallet, every transaction requires approval from the central trade. The transaction history can be not recorded on the underlying blockchain in real-time, and transaction costs are sometimes larger as a result of involvement of custodians and different intermediaries. There are completely different pockets types available in the market and each wallet has a corresponding public key and personal key.

It’s a sensible choice for seasoned merchants and traders who understand managing and safeguarding their non-public keys and seed phrases. Deciding between a non-custodial and custodial crypto wallet type is largely a matter of deciding which options in a pockets are most essential to you. Custodial wallets are typically preferred by newcomers and these who value the set-and-forget nature of managing their crypto via an exchange or other centralized wallet supplier.

In other words, the holders will not have full control over their funds, they only have to provide permission to ship or receive payments. Generally, the provision of non-custodial wallet services does not require a particular license or authorization; due to this fact, Web3 founders ought to contemplate common greatest practices during their legal structuring. For custodial wallets, the higher alternative will be to discover a jurisdiction with particular laws for companies in digital assets. Ideally, the jurisdiction ought to have relatively straightforward regulation and an uncomplicated authorization or licensing process. Most custodial options are very simple to use, that includes intuitive user interfaces created to make managing and trading assets protected and easy for newbies.

The determination between a custodial and non-custodial wallet is dependent upon a quantity of factors, including your stage of experience, your desire for management versus convenience, and your particular needs for the project. Remember that whether you utilize a custodial or non-custodial wallet, you need to all the time be cautious and follow greatest practices to guard your funds. There’s no distinction between a self-custodial (self-hosted or self-sovereign) pockets and a non-custodial wallet.

In the case of in style crypto exchanges that act as custodians, they offer a user-friendly means for users to fund their accounts and begin trading their crypto. Choosing between a custodial pockets and non-custodial pockets is a key determination when it comes to securing your cryptocurrency holdings. Some prefer a custodial exchange account, while others favor non-custodial wallets, and some end up using a mix of the 2. You’ll also need to resolve if you’d like a hot or chilly wallet, and whether or not to unfold your cryptocurrency holdings between varied crypto wallets. Regardless of your selection, remember to always comply with finest safety practices. If you currently hold any cryptocurrency, you’ve probably already interacted with a crypto pockets before.

Fortunately, many non-custodial pockets providers give customers a restoration phrase or “seed phrase”. This phrase consists of random words, serving as a type of backup password recovery methodology, even when a wallet is lost, deleted or destroyed. But this phrase must be guarded just as rigorously as your personal key, as a outcome of anyone with the seed phrase will have the power to access the account.